Biggest action score climbers?

Biggest action score climbers?

I was wondering if it would be interesting to see the biggest action score climbers of the day or week or so. I would limit it to A and B graded stocks to keep the list relevant. I am not exactly sure if this would create any extra value, but I was thinking the biggest climbers would be stocks to watch and maybe start looking into. I would also think that typical value trap stocks would not show up on such a list, but I could be wrong on this.

Just a thought I had. Maybe you could run a small test screen and see what came up and let us know what you see?

Anyone else think this is a good idea?

Add Some Momentum Variables to the Screener

Add Some Momentum Variables to the Screener

I greatly appreciate how the Quality, Value, and Growth related variables combine to determine the OSV Action Score. I also appreciate the large number of variables available in the OSV Screener so us users can develop our own custom screens. However, I have found no Price Performance (aka Price Momentum) variables now available in the OSV Screener.

Many highly regarded studies have concluded that Momentum is also an important consideration in stock picking. Here are the ones available on my broker's (Schwab's) online Screener:

Price Performance:

Price Change

- Year To Date

- Last 5 Days

- Last Month

- Last 3 Months

- Last 6 Months

- Last 12 Month

Performance vs. S&P 500

- Year To Date

- Last Month

- Last 3 Months

- Last 6 Months

- Last 12 Months

Performance vs. Industry

- Year To Date

- Last Month

- Last 3 Months

- Last 6 Months

- Last 12 Months

Total Return

- 1 Year

- 3 Year

- 5 Year

- Percentage Below 52 Week High

- Percentage Above 52 Week Low

- Beta

I certainly don't expect you to include all these variables, but adding a few of them would be an important addition to the OSV Screener.

Thank you for your consideration.

WAAC Chart (Weighted Average Cost of Capital).

WAAC Chart (Weighted Average Cost of Capital).

I have been doing a course on Valuation by McKinsey (Great book). The core concept is that Value is created by the spread between ROIC and WACC. If a company's ROIC is higher than its WACC then the company creates value. If its WACC is higher than its ROIC it is destroying value.

Growth, is an accelerate. If the spread is positive. Growth creates value very quickly. If the spread is negative, value is destroyed much more quickly.

It would be useful to have a WACC for the stocks.

Dividend Stock related numbers

Dividend Stock related numbers

I'd love to have (Free Cash Flow / Dividends Paid) in the key ratios section. Maybe dividends are pretty unpopular with the user base here, but this is an important ratio for those of us that look at dividend stocks. It's easy enough to calculate from the financials but it would be a nice time saver.

---------

[EDIT] Please post your 2 must have calculations to analyze dividend stocks.

Ability to screen based on median P/E from key ratios

Ability to screen based on median P/E from key ratios

The 5yr min, 5yr max, and median numbers are already available when you click into Key Stats for a given company. However, if we could add this into the Statistic List of the Edit Screener mode, it'd be great to export and sort companies with current P/E < 5yr median P/E. Seems like a rather feature to implement but could be immensely useful.

Measure Personal Portfolio Performance

Measure Personal Portfolio Performance

Can we have a portfolio tracker that calculates Time-weighted and Dollar-weighted Returns using Industry Standard Calculation Methodologies with those specified in the Global Investment Performance Standard, or "GIPS" standard.

Terrific Update -- Enter Multiple Ticker Symbols in Search Input Box

This feature is a huge advancement for users in two ways:

1. We can now easily enter in the Search Input Box our own custom list of those company tickers we want to compare; and

2. We can now sort the companies shown in any Stock Database and any Screener used for any column heading from high-to-low or from low-to-high.

extended dupont analysis

extended dupont analysis

Can we add the extended dupont analysis to breakdown the components of ROE?

Two Short Interest Data Points

Two Short Interest Data Points

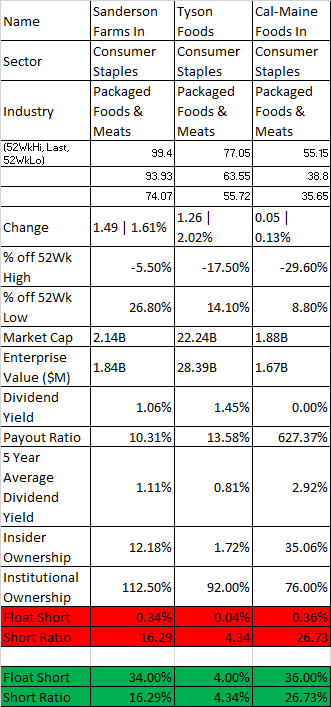

Reference default settings in Compare Competitors/Basic category.

Red below shows actual display (very confusing to us users).

Green shows user-friendly format for 'short interest' data.

I believe short interest shares by company are reported twice a month. Are you using the most recent data?

Also please re-check method of calculation. The two Sanderson numbers in particular seem incorrect in relation to each other.

Customer support service by UserEcho