Really superb features (The comparison feature). Its very powerful for understanding each company in relation to its competitors..

Really superb features (The comparison feature). Its very powerful for understanding each company in relation to its competitors..

This is just the tip of the iceberg of what can be accomplished. I think if you have a free version of this site, say for the Dow 30 stocks so that prospective investors can come have a look at what is possible you would probably draw a lot of interest.

Also eventually you might incorporate an online stock forum like Seeking Alpha so that investors could discuss analysis of various stocks, it might make Old School Value a hub of interesting analysis and ideas. (Of course, that is probably a huge undertaking in itself so you might want to leave it until later.)

Also suggest watermarking your graphs with the Old School Value logo. If people take a screen capture and use it on Seeking Alpha its good free advertising for Old School Value.

Please add the stock PEG ratio to the stock summary and stock comparison tabs. Also the stock beta value would be helpful as sometimes it is used as a selection criteria.

Please add the stock PEG ratio to the stock summary and stock comparison tabs. Also the stock beta value would be helpful as sometimes it is used as a selection criteria.

Please add the stock PEG ratio to the stock summary and stock comparison tabs. Also the stock 52W low / 52W high and beta value would be helpful as sometimes are used as one of the selection criteria.

Option to input data in WACC (CAPM)

Option to input data in WACC (CAPM)

data inputs for WACC, including CAPM. You can possibly have an optional beta feature, or default to industry from a reputable source.

Could you add the projected 5-year growth rate to the "key stats" view on the summary page?

Could you add the projected 5-year growth rate to the "key stats" view on the summary page?

Everyone knows the PEG ratio, and some people know the P/FCF/G or EV/FCF/G ratio. Right now it's hard to figure any of these without a lot of clicking around to find the estimated growth rate. Maybe put this data right up front and make it easier?

PDF Tips & Tutorials

PDF Tips & Tutorials

Put all of your recent tips in a single PDF for easy retention and storage. Or, point me to it, if you’ve already created/posted it.

Color scheme for the color blind

Color scheme for the color blind

It would be a very nice feature to have a setting to change the color scheme so color blind people have a better user experience with the system.

Financials and Key Stats

Love the presentation of this. It's simple, clean, and includes views of CROIC, Owner Earnings, Averages etc...without having to do it manually.

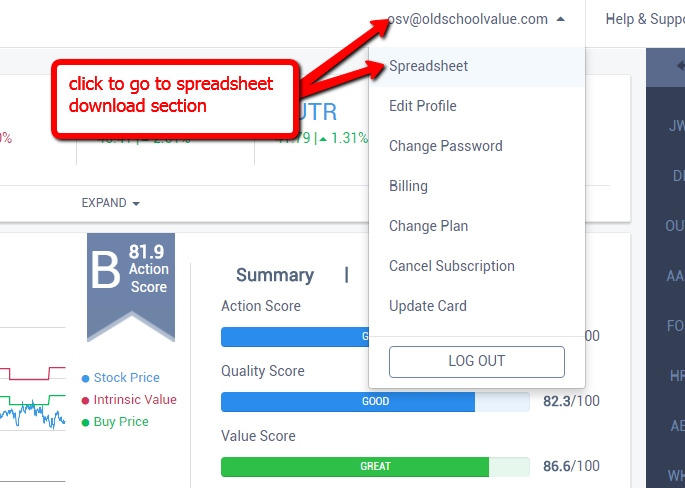

Provide a link to the latest download of the database so it is easy to find and download.

Provide a link to the latest download of the database so it is easy to find and download.

Go to menu > spreadsheet.

Then you'll see the link to download the database.

PRICE TO EPS CHART

PRICE TO EPS CHART

Hi Jae, bearing in mind that "price follows earnings, it would be nice if we can have access to a chart that graphs price to eps.

Customer support service by UserEcho