Your comments

2 Weeks ago you changed status on this idea to "Completed".

I have been checking this almost daily and it is still not available.

1. When will it be available to use?

2. In the future, please do not say it is "Completed" until it is fully tested, implemented, and available to users.

Thank you.

Fixed. Thank you.

Thank you. Good user-friendly fix.

OK, but you might want to reconsider now that you have fixed so many bugs and made OSV much more useful recently by adding some nice features (e.g. Screeners and Quality Checks come to mind)

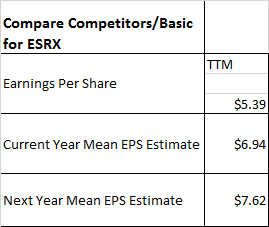

When evaluating any company (note: ESRX is only one example), it is useful to compare recent EPS actuals with estimates for current year and next year EPS. Here is the current OSV-displayed data:

As described in my first two comments above, the $5.39 GAAP EPS number should be changed to the Non-GAAP EPS (which is $6.39 in this example) in order to be comparable to the Non-GAAP EPS estimates of $6.94 and $7.62. It is deceptive to anyone now comparing these 3 numbers because they might be likely to erroneously conclude that ESRX's EPS is estimated to increase by 28.8% this year (from $5.39 TTM to $6.94 this year).

Thank you for switching to a variable discount rate by industry. Nice that I no longer have to do a manual look-up and change the discount rate for every company than I'm checking the OSV Valuation models for.

Here is some additional information I am providing that I hope will be helpful to you in determining how to reconcile current EPS inconsistencies.

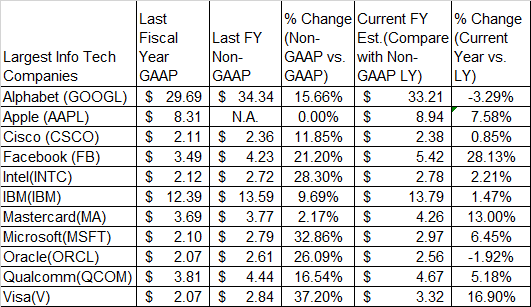

1. Observations (from table below):

- Of 11 companies shown, only Apple reports solely GAAP EPS.

- Analysts future EPS estimates are relative to past non-GAAP EPS. Future estimates are only relative to GAAP EPS for those companies that report only GAAP EPS.

Source: Schwab.com

2. Suggestion for OSV app:

- For companies reporting non-GAAP EPS, default numbers should be non-GAAP. For user clarity, all GAAP numbers displayed should be identified as such (i.e. include 'GAAP EPS' in description). And where GAAP EPS numbers are displayed, comparisons between that company's GAAP and non-GAAP EPS should be provided (such as those shown in the table above) to help us users to do accurate analysis of any company's EPS-related numbers. Thank you for addressing this topic.

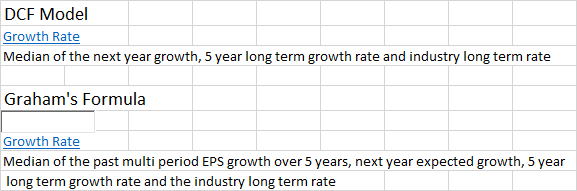

I disagree with using different company future growth rate estimates for two models (DCF and Graham), but that's your prerogative. As an example, Bank of America is a very large, slow growth company. The Growth Rate assumptions shown above of 12.56% for DCF and 16.62% for Graham are (1) Too high for this slow future growth company; and (2) a growth rate variance of 4.06% (16.62% - 12.56%) is much too high -- and fails the common sense test.

However, that is not really the main point in the initial post. The main point is that the 'Growth Rate' %s shown as the default numbers for both the DCF model and the Graham's Formula model are incorrect when calculating using the respective 'Growth Rate' bubble definitions provided in the app, which are shown to be:

As shown in the original post for Bank of America (BAC), if the DCF Model definition is used, the actual median 'Growth Rate' % would be 8.5%, not the 12.56% shown in the app. For both models, either (1) there is a calculation error in the app; or (2) the formula being used is different from the definitions as shown in the app for both models.

Jae,

You're missing 3 things that need to be addressed/fixed related to EPS:

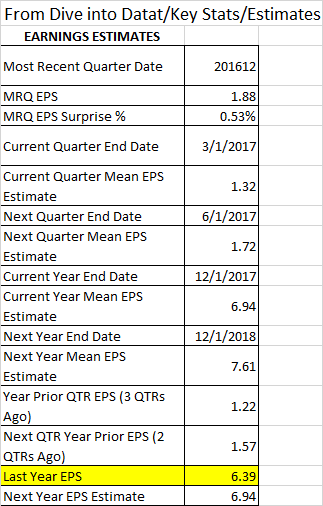

1. In the chart above, the $5.39 (which is last year GAAP) should be $6.39 instead (Non-GAAP) -- which is correctly shown (and highlighted in yellow in the chart below). The $6.39 relates to analysts consensus estimates of $6.94 for this year and $7.61 for next year.

2. In the chart below, the last line is wrong. The 'Next Year EPS Estimate' showing as $6.94 should be $7.61.

3. This is the most important point because it pertains to accuracy and consistency of the data points. Most companies report and reconcile GAAP and non-GAAP EPS numbers, and the differences between them are not insignificant or trivial. They are often substantial.

In order to correct ALL the inconsistencies in EPS as shown in my original post (using Hawaiian Holdings) above, you need to do a more comprehensive review of all EPS-related data points you use -- and make distinctions between GAAP and Non-GAAP numbers wherever and whenever necessary. This will not be a quick fix, but it is of paramount importance because accuracy of the information presented in this app is absolutely essential for us users.

Customer support service by UserEcho

For those of us that like to use some Price Momentum indicators in our Screeners, the Fourteen Price Peformance data points shown above by Jae are now available for use.

Note of clarification: For five Return vs. S&P500 data points, the values are the Percentage Points Difference in Returns. For example, if Company XYZ Last 12 Months Return was +12.0% and the S&P500 Last 12 Months Return was +19.0%, then the Last 12 Months Return vs. S&P500 for Company XYZ would be -7.0% [+12.0% - (+19.0%)].