Your comments

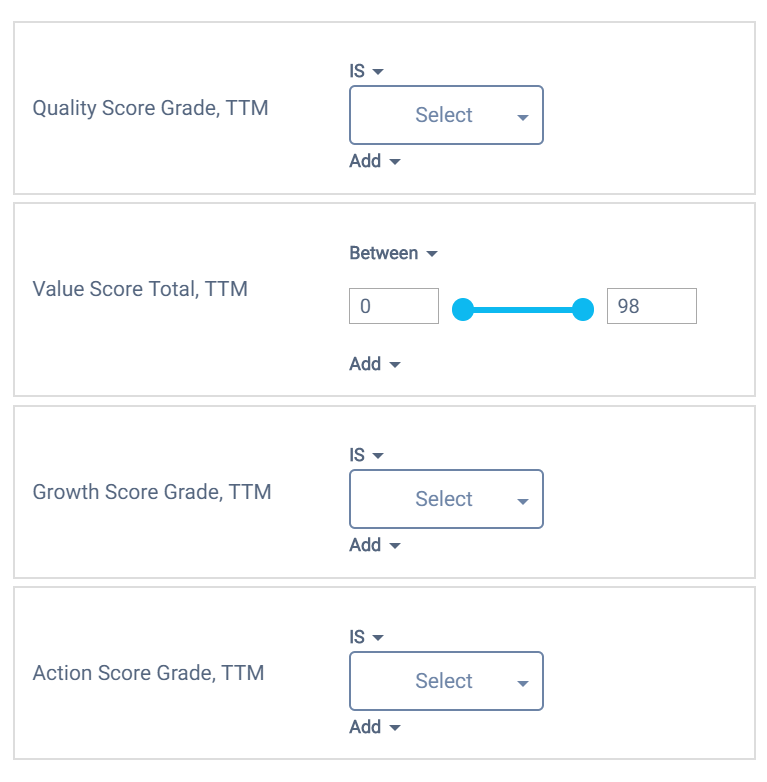

You can create a screener using the QVGA metrics. You can filter it by creating a new screener. You can also filter and sort easily if you export the data and open it in Excel.

Hi Brian. Thanks for your suggestion.

OSV Online and the spreadsheet does not work for companies categorized as financials, OTC, pink sheets and ADR's. While we do have data for these companies, the valuation methods and custom ratios we use are not 100% calculated due to the company's lack of financials.

Financial stocks have a different financial statement format which is not supported with the valuation models.

Not enough data is available for OTC and pink sheet stocks.

Some ADR's have issues because the filter does not convert their local currency to USD.

For more info, please read our knowledge base - https://feedback.oldschoolvalue.com/knowledge-bases/2/articles/31-otc-pink-sheets-data-support

Hi. This feature is already implemented. Please see this https://www.screencast.com/t/dylZNwBHE

When you click that button, you'll expand the page to a new Window.

Regarding multiple columns, this will depend on your screen real estate.

As for multiple filters, that's another thing. A good way to do this is to export the screener and just use Excel or Google Sheets to filter the results.

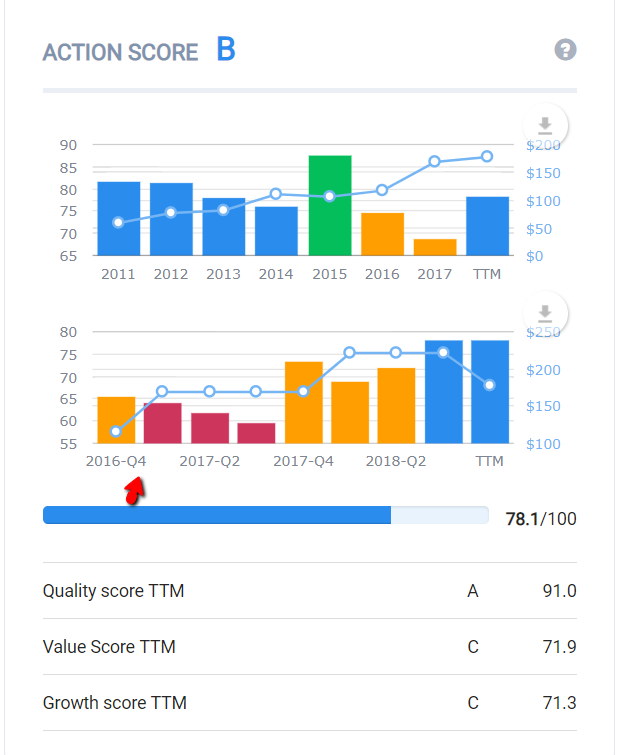

Released. Applied to each of the scores. So now there is an annual and qtr version.

Most likely what you'll see soon. Harder than I thought as we had to update some things to pull qtr into the app and then figuring out how to display 2 charts without making a mess.

The tickers you listed are in the app. I think you need to clear your browser's cache. You can follow the tutorial here https://kb.iu.edu/d/ahic

Hi Brian. May I ask what you're seeing? I see DDE.

Customer support service by UserEcho

Hi Jeff,

That post was from 2 years ago, and the v1 screeners were launched not long after. There is no imminent large change to the screeners functionality, but if you have ideas, please let us know!

Mike