Your comments

Thanks Dan. That's what I'm going for. Need everything to be as easy to understand as possible.

If you feel something is too messy and you have to strain to see or understand something, drop a note and I'll see what I can do.

this is finished and will be released in a week.

Kept it simple to only remember the MOS and Discount rates.

Other values can't be remembered as it doesn't make sense as every ticker has different values.

I have thought about how to generate an automatic report where you can select the parts that you want to see in a report.

Realistically, it's further down the road.

Actually this is something that I do want to do :)

Let each person create their own scoring formula. It makes total sense.

Now it's a matter of trying to get my head around how to make it work with everything else.

But that is a super suggestion and glad to see that someone using it is thinking the same thing.

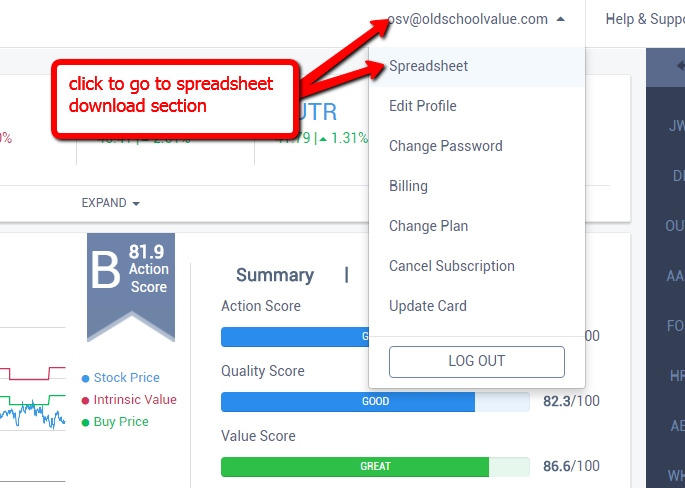

Go to menu > spreadsheet.

Then you'll see the link to download the database.

Ah yes I know this one from Greg. Also adapated from another value guy Adib Motiwala.

so this is similar with another thread asking to screen based on valuation.

The problem with this is that it will cause a huge number of mistakes. Valuation is very subjective and should be left for a per stock analysis. It should not be used as a screening criteria.

I understand the shortcut, but the miss rate will be far to high to make it worthwhile and lull people into a false sense of security.

one of the reasons why I'm looking to create a a price to intrinsic value chart for graham and EBIT.

no because valuation is too subjective to be a used for screening. You'll get a ton of hit and misses.

Having a really good customizable charts section is part of the plan.

Customer support service by UserEcho

adding delete function makes sense. Dont know about the edit as it would still push the stock down.