[OSV Tutorial] Answered! How I made the Action Score

(Ratings are past examples to help explain the concepts. Refer to the app for the latest data.)

What you'll learn:

- What is the purpose of the Action Score

- What makes up the Action Score Grading system

- Does it work?

It's our scoring system based on the Quality (Q),Value (V) and Growth (G) principle.

The Action Score is the average of Q,V and G.

If a stock has a high Q,V,G score, it means it is worth "taking action".

The purpose is to allow the stock grading system to do all the heavy lifting of finding stocks for you.

Instead of wading through an ocean of stocks before you find one worth investigating, the Action Score Grading system filters out the bad stuff and presents you with quality and actionable ideas right away.

I spent 1 year with a math professor to study, analyze, and determine what factors work. I'm not after the typical low PE and PB type metrics. I use off the charts metrics and ratios that Wall Street do not use.

If you don't need the details of how it works, click on "OSV Ratings" from within OSV Online app.

Otherwise, continue on.

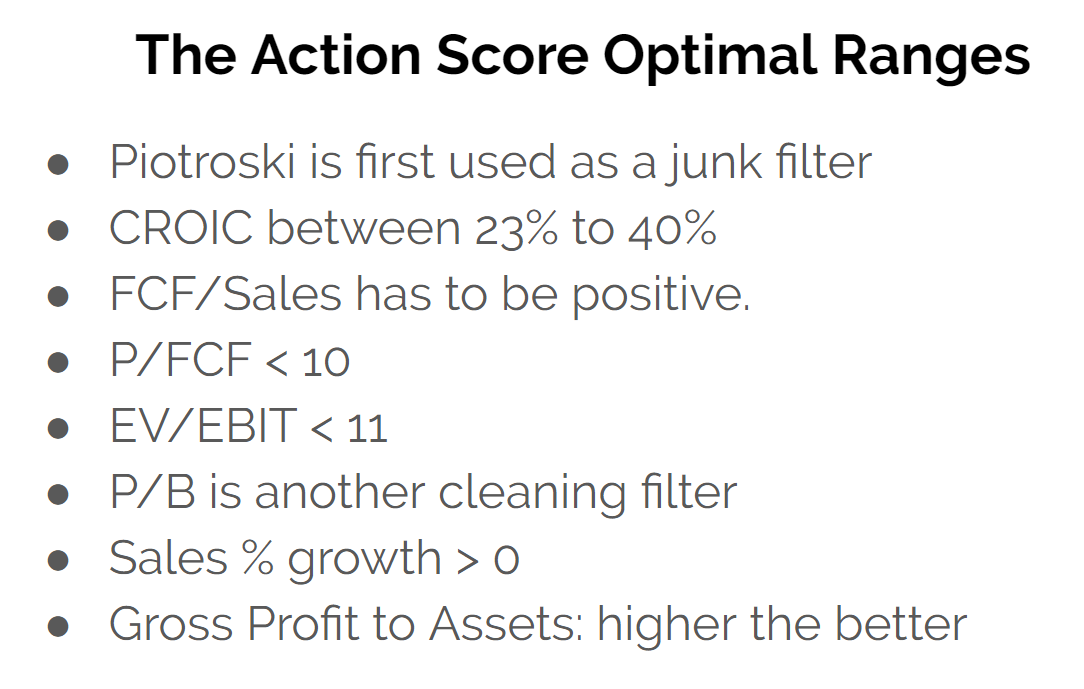

Here is what we look for in a stock.

Quality Score

- PIOTROSKI SCORE: Higher the better. Signals fundamental strength and used as a preliminary filter to demote low Piotroski score stocks.

- FCF/Sales: Signals cash generation ability and efficiency. FCF/Sales has to be positive.

- CROIC: signals competitive advantage and management effectiveness. CROIC between 23% to 40% is the best range and receives highest weighting.

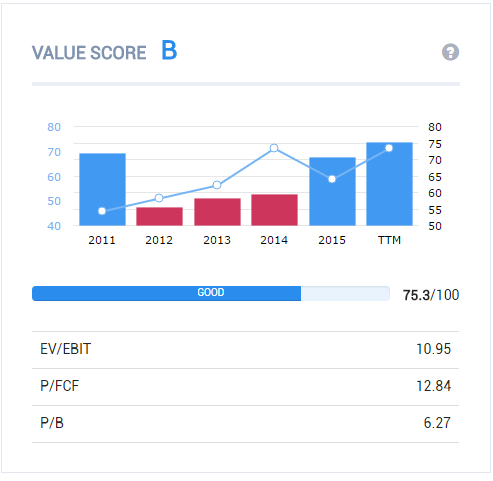

Value Score

- PIOTROSKI SCORE: Higher the better. Signals fundamental strength and used as a preliminary filter to demote low Piotroski score stocks.

- EV/EBIT: one of the best valuation ratios to identify cheap stocks. Best range is less than 11.

- P/FCF: biggest impact to the score with the best values being less than 10.

- P/B: acts as a cleaning filter to remove shell stocks and darling stocks. P/B has less relevance than the early days so the weighting is lowest.

Growth Score

- PIOTROSKI SCORE: Higher the better. Signals fundamental strength and used as a preliminary filter to demote low Piotroski score stocks.

- SALES CHANGE%: must be positive to seek growing companies within the last year.

- 5YR SALES CAGR%: must be positive to eliminate perennial losers inconsistent companies.

- GROSS PROFIT to ASSETS: measures the growth of profitability. In other words, are the assets profitable? A GPA of 0.5 means the company is generating profits of $0.50 for every dollar of assets.

That is why you will come across a stock where the other value numbers look better, but wonder why it has a low value score.

A low Piotroski is the reason.

We overweigh this factor for one reason.

It works.

Look at Apple (AAPL)

AAPL has very good value metrics.

Now look at Landstar Systems (LSTR).

LSTR may look slightly more expensive but AAPL has an Action score of C, while LSTR has an Action score of A.

Why?

The Piotroski F Score.

Apple has a Pio score of 5. Landstar is 8.

We don't try to over-complicate the scoring mechanism.

One of the reasons why many people sign up is because they are busy and the 17 years of backtesting results show how well it works.

Check out the full results and discussion in this link.

That's the basics of the Action Score.

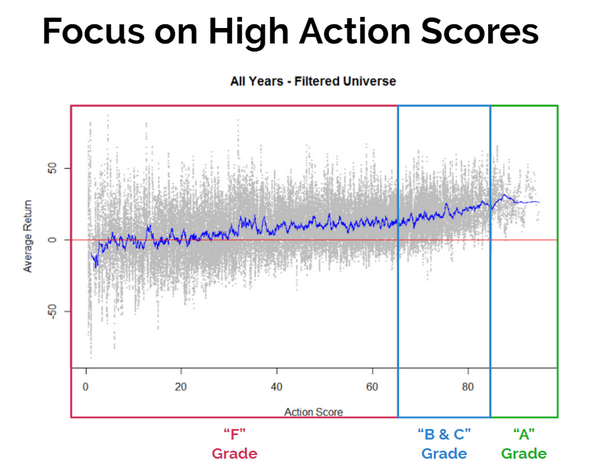

I put up a link to an independent test report of the Action Score and here's a graph that sums it up nicely.

You can see that the Action Score Stock Grading system is good at picking winners.

As the Action Score gets higher towards the right, the average returns also pick up.

The range of stocks you want to be focusing on are the A and B grade stocks. C's are borderline. They need a more thorough approach.

Here's how to maximize the Grading system.

- If you are a passive investor, pick (at least) 20 A grade stocks and hold for one year.

- If you are an active investor, use the Action Score to shorten your time searching.

Training Video

Here's a training session I did detailing how to understand and interpret the Action Score, the grades and how to leverage it to your advantage.

Next time I'll give you a quick 4 step process to use OSV Online for max efficiency.

Resources:

Customer support service by UserEcho