0

Not a bug

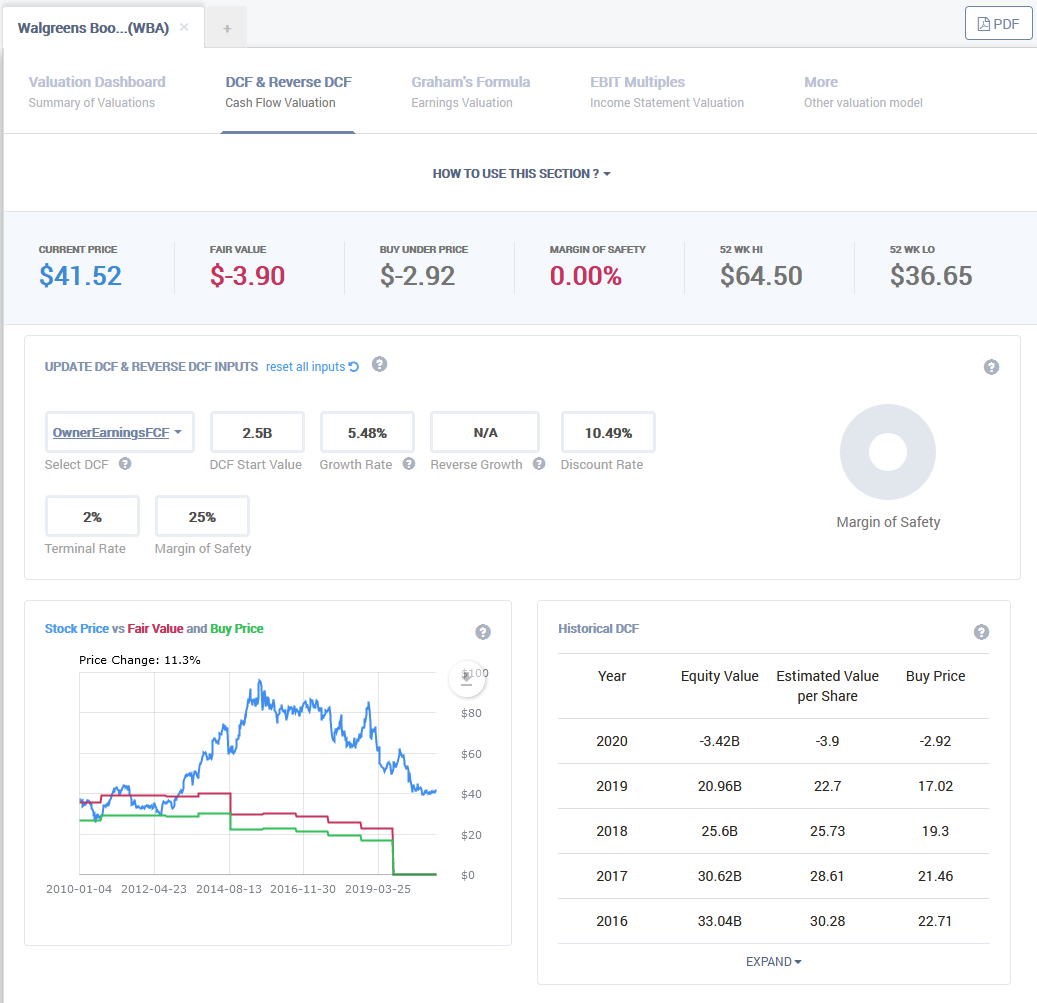

Bug in owner earings FCF for Boots (WBA)?

It looks strange that the fair value should be negative with 2.5B in owner earnings FCF and a positive growth rate? Am I missing something?

Customer support service by UserEcho

You can think of Owner Earnings as a more conservative version of Free Cash Flow. In this case, in the trailing 12 months, WBA's Owner Earnings is almost $2B less than its FCF. This appears to mostly be a blip, as in general, FCF and OE for WBA track pretty closely, so you should probably look into why there's a big divergence. Anyway, in this case, the default DCF settings use the TTM Owner Earnings, which is much lower. This results in a lower present value of the enterprise, so when you subtract out debt, the value of the equity goes below zero. This may not be representative of the go-forward cash flows, though, so I suggest you think about whether the $2.5B or something more like $4-4.5B is a better starting point for cash flows.