Auto-Fill for Compare Competitors

Excellent new feature on auto-fill of industry competitors in Compare Competitors section!

sloan ratio

sloan ratio

Will you be adding a Sloan ratio calculation into the program and the screener?

Median Key Stats within screener

Median Key Stats within screener

would love to do screens with reference to median Key Stats...for example screening for companies with highest meidan 5yr ROIC....seems like data is already there on key stats but nice if i could screen and then sort by those numbers....

Back Testing Data

Back Testing Data

Can you run enable us to run the screeners with data from prior dates so we can test our theories. I'm sure each date would mean providing 100% more data than currently available, but are you able to do at least a couple, say Jan 1st 2015 & 2016? Or being greedy, each year from say 2007?

Round numbers to thousands instead of millions

Round numbers to thousands instead of millions

Nasdaq shows "$120" in cash (values in 000's) that means it's about $120,000.

OldSchoolValue shows "0.1" which I read as $100,000. This is somewhat acceptable, though not very old school. The difference seems insignificant. However, when the entire trend goes like the table below for cash:

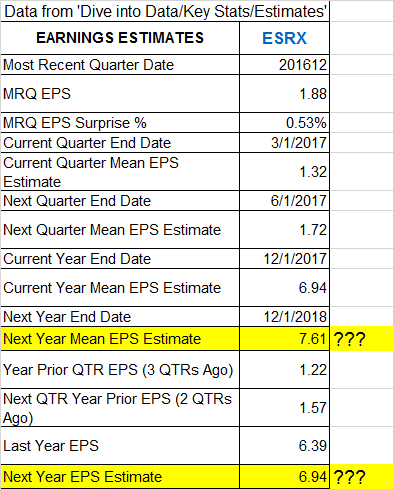

Conflicting Next Year Earnings Estimates

Conflicting Next Year Earnings Estimates

Below, $7.61 is correct. $6.94 is incorrect.

Suggest simply deleting last line showing 'Next Year EPS Estimate' of $6.94 on display page of 'Dive into Data/Key Stats/Estimates'.

dividend yield is zero payout ratio is 79%

dividend yield is zero payout ratio is 79%

For RHHBY Roche the key stats page has the dividend yield as 0% (the same on the summary page) but the payout ratio as 79%. Is there a problem with ADR's?

% Off 52 Wk High and % Off 52 Week Low

% Off 52 Wk High and % Off 52 Week Low

Both %s show erroneously as -100.0% for any company viewed in Key Stats/Key Stats display. Note: they do show correctly in the Compare Competitors display.

Financial Statements

I like to dig into the financial statements of companies I'm considering investing in. I love the way you provide several prior years (and quarters) of historical data along with the ability to show the % change from comparable prior year (and quarter). This is very useful (and also displayed in a user friendly manner). Thank you.

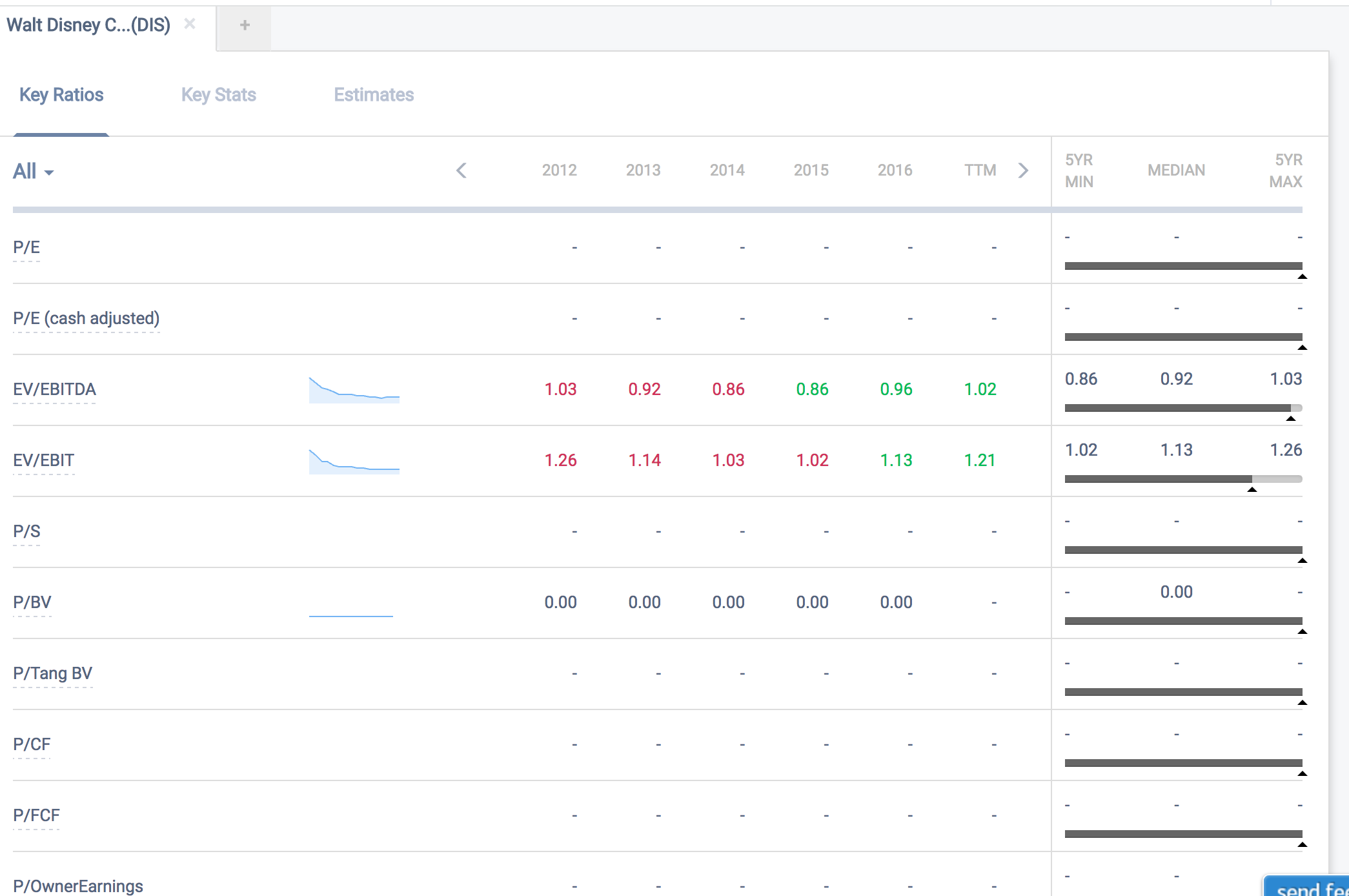

Not sure what the issue is

Not sure what the issue is

Something is clearly wrong. This is the Disney key ratio page I pulled up.

Customer support service by UserEcho