Consistent Use of 'Fair Value' on Summary page

Consistent Use of 'Fair Value' on Summary page

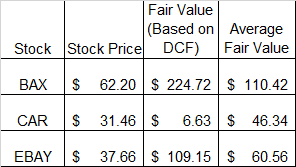

OSV has 3 methods for determining fair value -- DCF, Graham, and EBIT

On Summary page:

1. 'Fair Value' on chart uses only the DCF value

2. Margin of Safety % calculation uses median value of the 3 methods as the fair value

3. Summary page also shows the 'Average Fair Value' of the 3 valuation methods.

Using these 3 different Fair Values is confusing (and unnecessary).

To be consistent, I suggest using the 'Average Fair Value' in #1 and #2 above. Since OSV has 3 valuation methods, consistently using 'Average Fair Value' seems both logical and sensible; and with the added benefit of being more understandable (i.e. more user friendly).

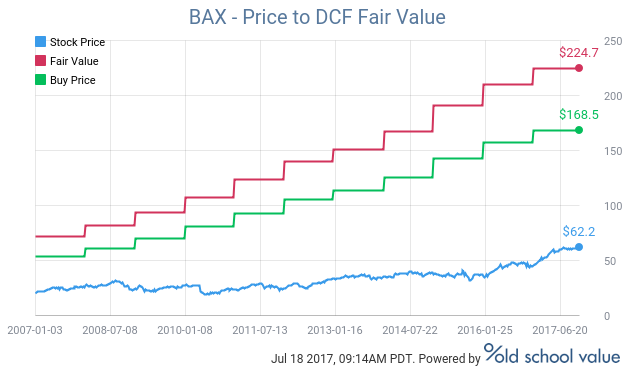

'Summary' Chart 'Fair Value'

'Summary' Chart 'Fair Value'

Suggest using Average Fair Value (average of all 3 Valuation metrics -- DCF, Graham, and EBIT) instead of only DCF on 'Summary' chart for individual stocks. Three examples:

and current 'Summary' chart for BAX:

Negative DCF Value for TEVA

Negative DCF Value for TEVA

Something wrong with DCF calculation method? How can DCF (Net Income/EPS method) value for TEVA be -$18.07 per share when cash flows are positive, net income is positive, and future growth estimates are positive?

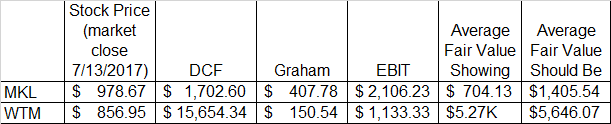

Avg Fair Value when Any of 3 Valuation Methods has Valuation >$1,000

Avg Fair Value when Any of 3 Valuation Methods has Valuation >$1,000

In 'Valuation' section, seems 'Average Fair Value' is in error when any of the 3 valuation methods (DCF, Graham, or EBIT) has a value >$1,000. Here are two examples:

Equation of ROE

Equation of ROE

Hi, Jae

Could you add the equation of Return of Equity in the description?

Because I need to confirm the equation.

Thanks.

Hunghao

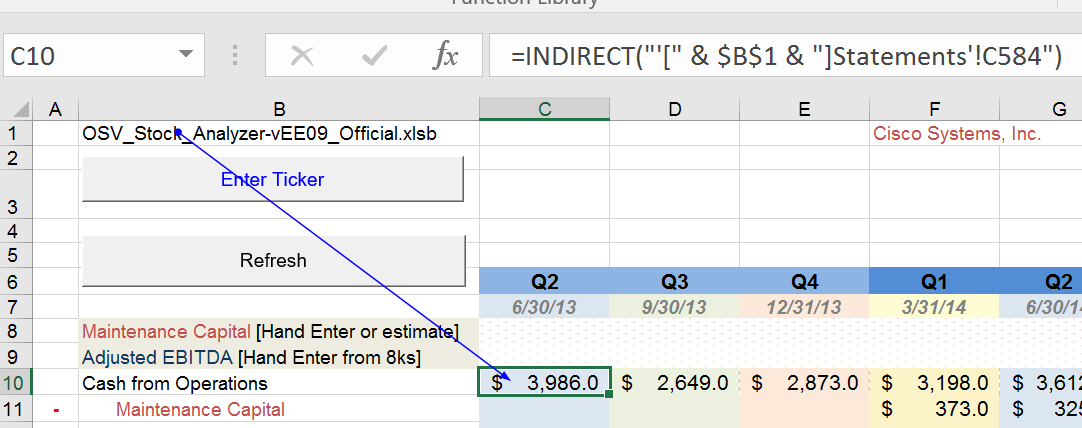

Moving custom spreadsheet to latest version

Moving custom spreadsheet to latest version

Can anyone tell me how a customized sheet in an OSV Stock Analyzer workbook is transferred from a current OSV workbook to a new (ie, version update) workbook (example EC05 to EE09)

Please include all the steps - for instance -

I think you must be signed in to the workbook for it to 'open' but it seems you can only have 1 workbook opened at a time.

Updating links to older workbook pages to same links in new pages

Thanks for any help

Use the INDIRECT function in every cell in the custom worksheet that links to a cell in a standard worksheet and concatenate a reference to a cell that contains the name of the workbook. As an example if the cell in the custom worksheet links to a cell in the standard "Statements" worksheet create a cell such as B1 to hold the name of the workbook OSV_Stock_Analyzer-vEE09_Official.xlsb

In the custom cell that links to say a Cash from Operations cell in the standard Statements worksheet replace =Statements!EC84 with

=INDIRECT("'[" & $B$1 & "]Statements'!C584")

Note the nomenclature in my version of excel requires the single apostrophe before the first [ and between the worksheet name & the !

If all your links are created this way all you need to do is open the new workbook along with the old, right click on the worksheet tab, choose copy to the new workbook. Once copied change the name of the workbook in cell B1 to the new workbook name. As long as the standard sheets in the new workbook maintains the same data in the same cells as the original workbook everything will be fine.

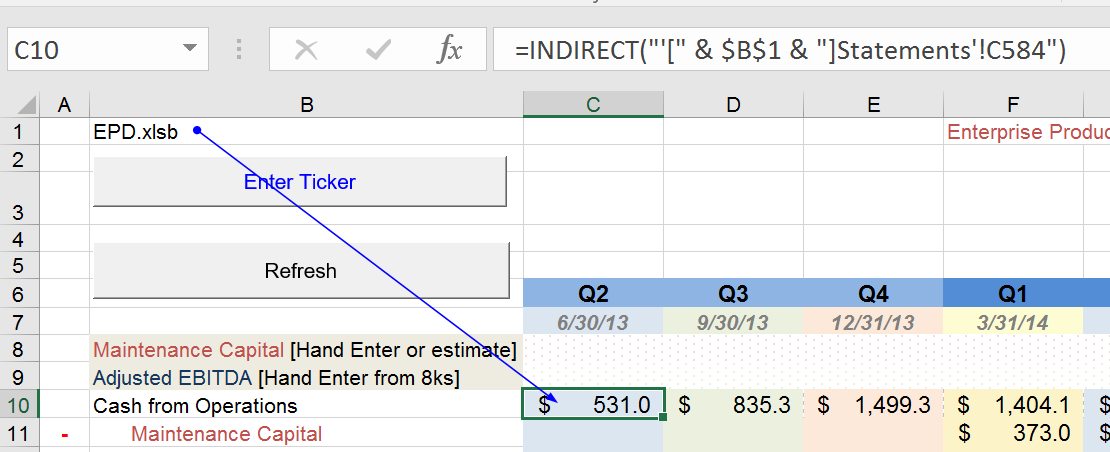

For example, if the new workbook is named EPD.xlsb the transferred worksheet will look like,

Composite bond rate link is dead

Composite bond rate link is dead

The Composite Bond Rate link for Yahoo Finance in the Graham Formula Earnings Valuation tool is dead. It looks like other people have been asking the same question on why it's dead. Here's an alternative I found that looks most like the previous Yahoo Finance data, though I didn't do an exhaustive search. Cheers!

Customer support service by UserEcho