Your comments

1. Thanks for info in your reply about CAGR. For clarity, that should be easy to add to description bubbles (not only for the dividend growth variables, but also if it also applies to all other growth-related variables).

2. Regarding DDM specifically, I would not use it. My opinion is that 3 Valuation methods (currently DCF, Graham, and EBIT) is ideal. I would ask you to only add another model (such as DDM) if you are convinced it is better than one of your existing 3 models. If so, then replace the existing model with the better model; but again, 3 valuation models is enough.

I like that you already have available in the Screener both the current annual Dividend Yield and the 5 Yr Avg Div Yld as screening variables. Suggest adding 3 Yr Avg and 10 Yr Avg as Screener variables if not difficult to do.

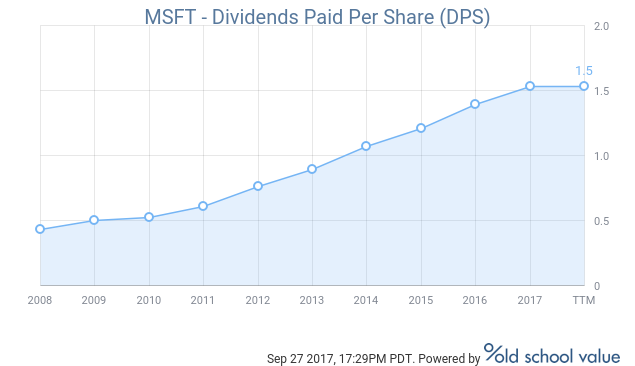

After looking at Current Div Yld and 5-Yr Avg Yld, if I want to look at the Dividends Per Share trend over the past 10 years, I just go to the Income Statement data. Here's a terrific chart example for Microsoft that is already available from OSV:

For those users interested in Dividend growth rates, the OSV Screener also has variables for Dividends Paid Per Share (DPS) for (1) the past 3 Yrs Growth; (2) the past 5 Yrs Growth; (3) the past 7 Yrs Growth; and (4) the past 10 Yrs Growth.

However, it should be noted that it is unclear from the information boxes attached to these variables whether the 'Growth' in each case is (a) compound annual growth rate %; or (b) average annual growth rate %; or (c) total growth % over the number of years specified.

Also Note: there are many, many variables in OSV where the explanations in their associated information boxes need much greater clarity to facilitate user understanding of precisely what each particular variable is measuring.

Please do this as soon as possible. Thank you.

Still cannot enter 'Between' numbers in two boxes when in Screener mode.

Is 'Charts' feature still in the works? -- I hope it is!

I noticed when the 'Training' feature was added, the future 'Charts' feature was removed.

Please reply to comment from 1 week ago regarding inaccuracy of calculating Altman Z for anything other than 12-month periods.

This is a simple user-friendliness issue.

Currently there is no way to change the order in which the "Your Screen" column headings are displayed. Users should at least be able to "Edit" the column display order when in "Your Screen" to conform to our personal preference as to the most logical display order. On the "Your Screen" page, the "Edit" button in the header on the right side should be used for this purpose, not to arbitrarily switch the user to the "Basic" display. If users wants to switch to the "Basic" display, we can simply click on the "Basic" header to do so.

Jae,

Yes, like Google Finance charts. You might also check out a service called StockCharts.com as they have terrific charting capabilities. I have no idea what it would cost you to obtain their service.

I think you missed my point. Altman Z scores require 12-month time periods.

The underlying reason for this is that variables X3(EBIT) and X5(Sales) for only 3 months cannot be compared to EBIT and Sales for 12 months.

Therefore, please delete MRQ Z score info.

Customer support service by UserEcho

Jae,

Your thoughts on this suggestion?