[OSV Tutorial] Why there is no perfect system - or silver bullet

(any stock examples in the tutorial emails are for illustration purposes only. Refer to the latest data in the app.)

What you'll learn:

- What type of results to expect

- How the Action Score COULD fail

- Why there is no fail-safe solution

When I run the backtests, it selects the top 20 stocks at the beginning of the year, holds for one year and then re-balances.

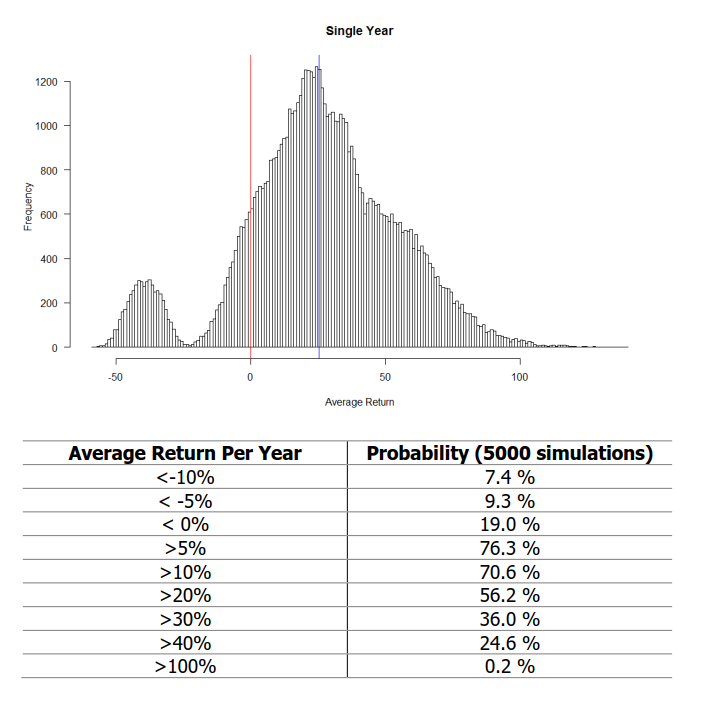

If you read the independent Action Score test report (log in > menu > download area), you likely came across this chart showing the possible distribution of returns.

In this simulation, a single year between 1999-2015 was picked at random, and 20 A grade stocks were then randomly selected.

This was performed 5000 times.

The good news is that the ratio of a return greater than 0% is higher than negative returns.

The red line is 0%. The blue line is the average return which is 23.2%

BUT there is still a

- 19% chance of losing money ( < 0%)

- 81% of making money (> 0%)

If the market is up 10%, you could finish with 5%.

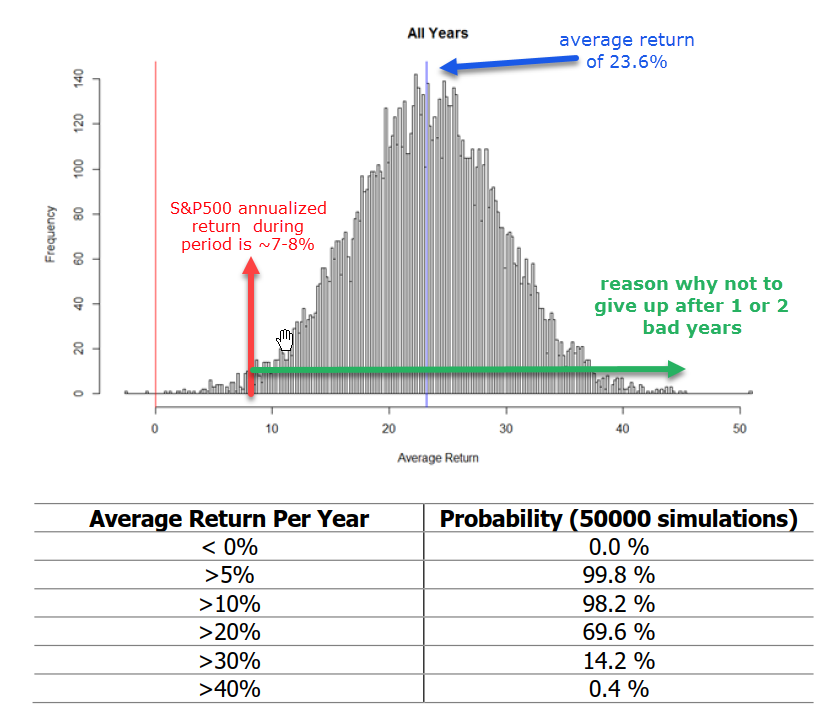

But the reason not to give up after 1 or 2 years is because of this.

Over a 17 year period, the average return comes out to 23.6% (commissions, slippage, taxes not factored), the more likely scenario is going to be a return between 10-20%.

The ratio of losing money is at 0% if you stick with it long enough.

The ratio of beating the market is staggering.

The key point is to remember that based upon extensive testing and a short history with real money accounts, it's proving to work.

Aiming for Better Performance

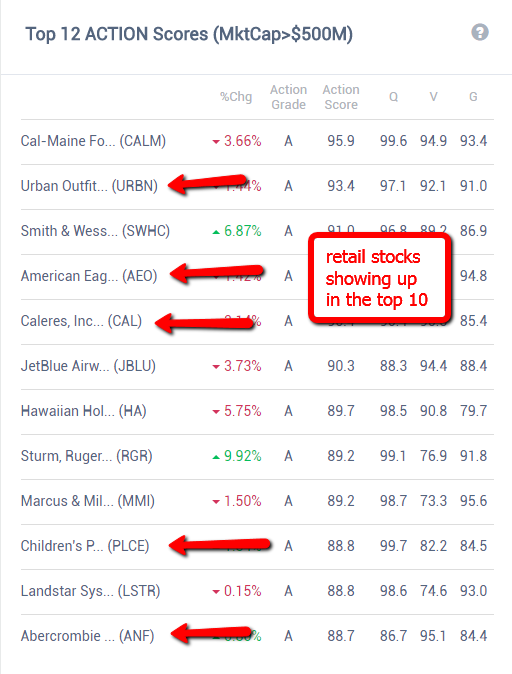

There will be a stocks that fall through the gaps and fall in the top 20 somehow. Simply put, there is no way to clean up every possible combination of Q,V,G across thousands of stocks.

Spreading your bets eliminates this risk.

To close, I want to share what Richard shared. He has been an OSV Insider from the early days and posted a great comment of his simple process.

==========

So the new system is working out quite well. I have found several excellent investment ideas that I have taken action on. I use it in conjunction with the trusty OSV spreadsheets which I have become totally dependent on for making really good decisions.

I have learned from experience that it is best not to rely solely on screening selections. Once you learn how to use original OSV spreadsheets and learned how to interpret financial statements its pretty easy to sort the good companies from the weak or iffy candidates.

I tend to stick with best of breed. I don't like to risk money on flyers and would rather make a lesser profit, but not have to worry about my capital evaporating because they are invested in shaky companies.

==========

As Richard said, using your judgement can help you achieve greater returns, eliminate risk and help you focus on the best of breed.

Customer support service by UserEcho